Payment Information

In order to get paid by us, you’ll need to provide your payment details under Payment Information – select that option from the drop-down in the top-right corner.

Updating Your Payment Information

Accounts created before March 2017 need to re-submit their payment information. Please go to Payment Information and update your info if you haven’t done so yet.

If your bank is located in a different country or territory than your company or business address, you won’t be able to configure different countries by yourself. Please contact us at [email protected].

Payment Modalities and Thresholds

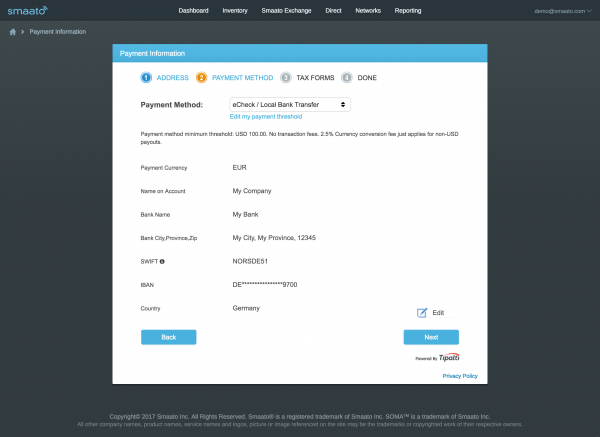

All current payment modalities are reflected in the payment suite; if you’re unsure regarding your own payment method, head to Payment Method (page two of the Payment Information suite) for more information.

Currently, Smaato offers payouts via PayPal and Wire Transfer (Bank Transfer).

Smaato follows a 60-day payment schedule. Smaato will pay you your net revenue share within sixty days after the end of the calendar month in which revenue was accrued.

There’s a general payout threshold of USD$100 for all payment methods. This can, of course, be accrued over multiple months (i.e., as soon as your account has accrued over $100, you can request for a payout). Smaato will roll over the amount payable to you to the subsequent payout cycle until at least $100 are reached.

Smaato handles payments in U.S. Dollars (USD). Depending on your country of residence, you can get paid out in your local currency.

There’s no Smaato-side fee for PayPal payouts. Wire transfers may be subject to fees, depending on your bank or country of residence. More detail is provided under the Payment Method (page 2 of the Payment Information suite) upon specifying your payment method and information.

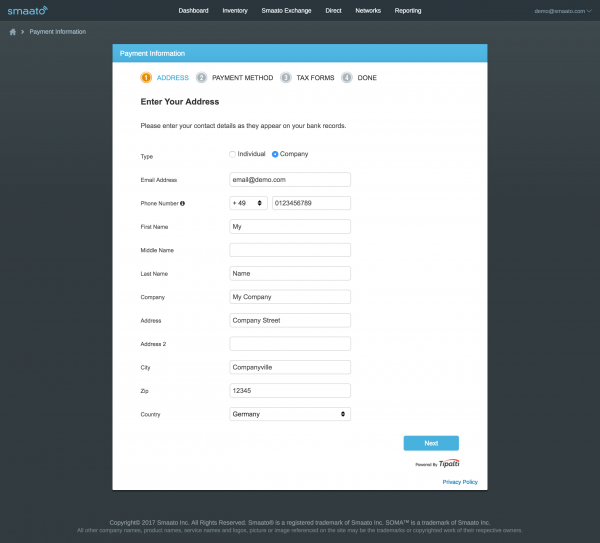

Entering Your Address

You will be prompted to enter your business address and information first (click to enlarge):

Specifying Your Payment Method

Next, you’ll need to specify your preferred payment method; you can choose between wire transfer and PayPal:

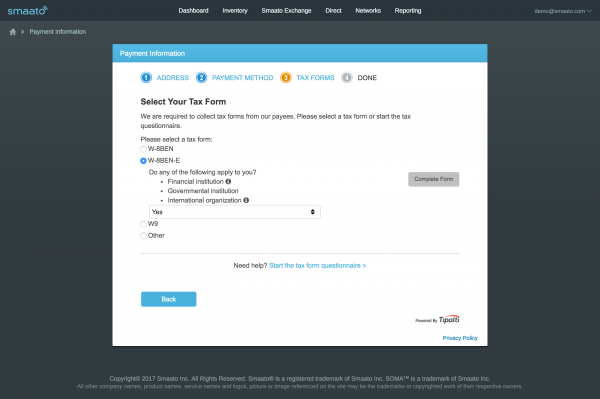

Submitting Your Tax Form

Now, you just have to submit your applicable tax form; if you’re not sure which form to choose yet, click on the Start the tax form questionnaire link to learn more.

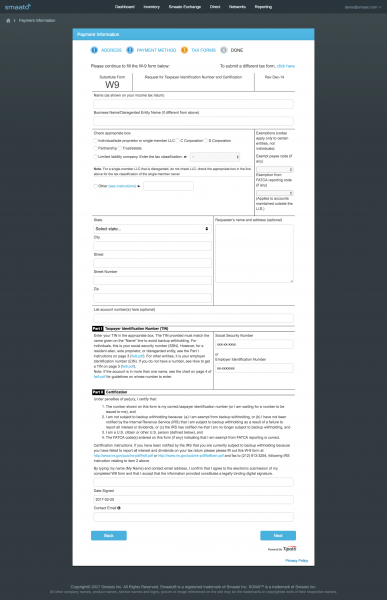

Example of selecting a W-9:

Then, you will need to provide the necessary tax form details as prompted in the forms.

When you have submitted your tax information, you are done!

Last Modified: August 31, 2023 at 11:50 am